Written by: Segun Akomolafe

Taking control of your finances starts with one fundamental skill: tracking your monthly expenses. Whether you’re trying to save for a major purchase, eliminate debt, or simply understand where your money goes, expense tracking provides the clarity and insights needed to make informed financial decisions.

This comprehensive guide will walk you through proven methods on how to track your monthly expenses, helping you build and achieve your financial goals.

Why Tracking Your Expenses Matters

Before diving into how to track your monthly expenses, you need to first understand the impact of expense tracking. When you monitor your spending, you gain visibility into spending patterns you might not realize exist. That daily coffee run? It could be costing you $150 monthly. Multiple streaming subscriptions? They add up to $75 or more.

Tracking also helps you:

- Identify unnecessary expenses draining your budget

- Prevent overspending before it becomes a problem

- Make data-driven decisions about where to cut costs

- Build realistic budgets based on actual spending patterns

- Spot fraudulent charges or billing errors quickly

Step 1: Gather All Your Financial Statements

The first step on how to track your monthly expenses is to start by collecting statements from every account where money flows in or out. This includes:

Bank accounts: Checking and savings account statements from the past 1-3 months provide a baseline of your spending habits.

Credit card statements: Review all cards you use, even occasionally. Credit cards often reveal discretionary spending that’s easy to overlook.

Digital payment platforms: Don’t forget Venmo, PayPal, Cash App, or Apple Pay transactions. These digital payments can represent significant spending.

Cash withdrawals: Note ATM withdrawals and try to recall where that cash went. Cash spending is notoriously difficult to track but equally important.

Review these statements to identify two types of expenses:

Fixed expenses remain relatively constant each month—rent or mortgage, insurance premiums, car payments, subscription services, and minimum debt payments.

Variable expenses fluctuate based on your choices—groceries, dining out, entertainment, gas, clothing, and personal care.

Read more: Debt Snowball vs. Avalanche Method: Which Pays Off Debt Faster?

Step 2: Choose Your Tracking Method

Different methods work for different people. Consider these options based on your preferences and lifestyle:

Budgeting Apps

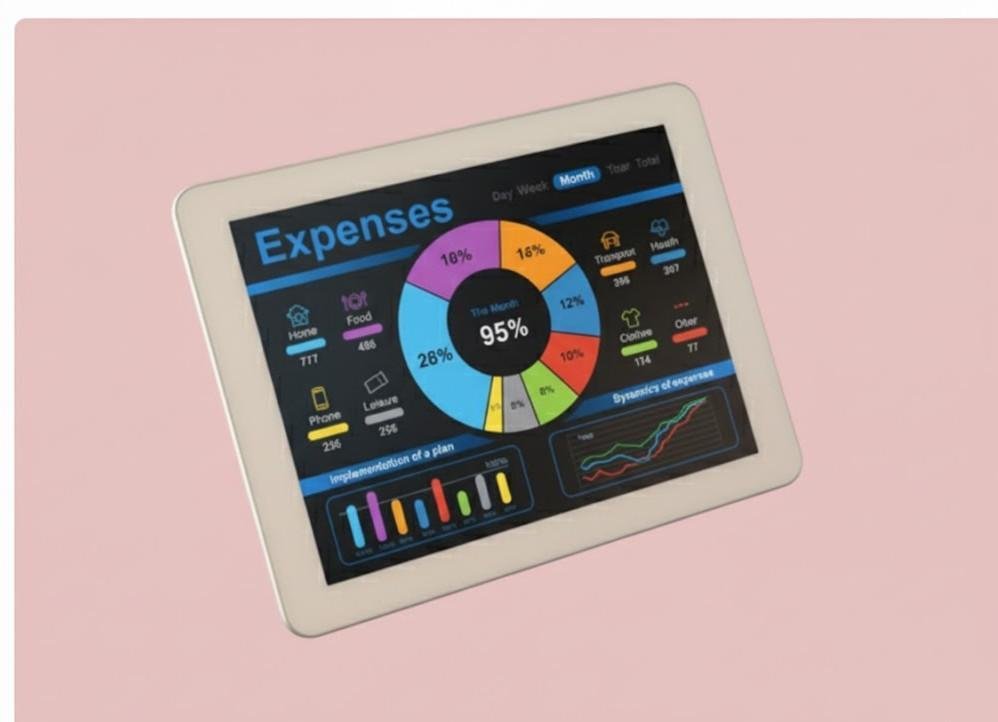

Modern expense-tracking apps automatically categorize transactions, sync with your bank accounts, and provide real-time spending updates. Popular options include Mint, YNAB (You Need A Budget), PocketGuard, and Goodbudget.

Advantages: Automation saves time, visual charts make patterns obvious, alerts prevent overspending, and accessibility from your phone makes tracking convenient.

Best for: Tech-savvy users comfortable linking financial accounts, people who want minimal manual entry, and visual learners who benefit from charts and graphs.

Read more: How to Create a Debt-Free Budget: 5 Key Strategies

Spreadsheets

Creating a financial spreadsheet (using Excel, Google Sheets, or Numbers) gives you complete control over categories, formulas, and layout. You can create custom templates or download free budget templates online.

Advantages: Highly customizable, no subscription fees, works offline, and you maintain complete control over your data privacy.

Best for: People who enjoy hands-on financial management, those with privacy concerns about linking bank accounts, and individuals with complex financial situations.

Pen and Paper

A physical budget notebook or journal might seem old-fashioned, but it works. Writing expenses by hand increases mindfulness about spending.

Advantages: No technology required, enhances spending awareness through the physical act of writing, and is completely private.

Best for: Those who prefer tangible tracking, people trying to break unhealthy spending patterns through increased awareness, and anyone who finds digital tools overwhelming.

Read more: A Deep Dive into Secured vs Unsecured Loan

Banking Tools

Many banks now offer built-in expense tracking and categorization within their apps and websites. These native tools automatically sort transactions and often provide spending insights.

Advantages: Already integrated with your accounts, no third-party access needed, and free to use.

Best for: Those who prefer keeping everything in one place, people hesitant to use third-party apps, and anyone who banks with institutions offering robust tracking features.

Here’s an optimized table for the second step on how to track your monthly expenses;

| Tracking Method | Best For | Key Benefits |

|---|---|---|

| Budgeting Apps (Mint, YNAB, PocketGuard) | Tech-savvy users who want automation | Automatic categorization, real-time updates, spending alerts, visual charts |

| Spreadsheets (Excel, Google Sheets) | Hands-on managers with privacy concerns | Complete customization, no subscription fees, offline access, full data control |

| Pen and Paper | Those building spending awareness | No technology needed, increases mindfulness, completely private, tactile engagement |

| Banking Tools | Users preferring all-in-one solutions | Already integrated, no third-party access, free with account, automatic syncing |

| Hybrid Approach | People wanting flexibility and backup | Combines automation with manual oversight, multiple data sources, adaptable to needs |

Step 3: Categorize Your Expenses Effectively

The third step on how to track your monthly expenses is to categorize your expenses. Once you’ve chosen a tracking method, organize expenses into meaningful categories. For example, you can make a categorical list for what you spend on insurance, food & groceries, taxes and transportation. This organization reveals spending patterns and helps identify areas for improvement. Other necessary expenses include;

Essential Living Expenses (Housing & Utilities)

- Mortgage or rent payments

- Property taxes and HOA fees

- Homeowners or renters insurance

- Electricity, gas, and water

Food and Groceries

- Grocery shopping

- Dining out and takeout

- Coffee shops

- Work lunches

- Meal delivery services

Healthcare

- Health insurance premiums

- Co-pays and deductibles

- Prescription medications

- Dental and vision care

- Mental health services

Debt Payments

- Credit card payments

- Student loan payments

- Personal loan payments

- Medical debt payments

Personal and Discretionary

- Clothing and accessories

- Entertainment (movies, concerts, events)

- Hobbies and recreational activities

- Gym memberships

- Personal care (haircuts, cosmetics)

- Gifts and donations

Savings and Investments

- Emergency fund contributions

- Retirement account contributions

- Investment account deposits

- College savings plans

Customize these categories to match your lifestyle. If you have children, add childcare and education. If you’re a freelancer, include business expenses. The goal is creating a system that accurately reflects your financial life.

Read more: How to Pay Off Debt Quickly

Step 4: Implement the 50/30/20 Rule

The 50/30/20 budgeting framework provides structure for expense tracking. This method divides your after-tax income into three buckets:

50% for Needs: Essential expenses you cannot eliminate—housing, utilities, transportation, minimum debt payments, insurance, basic groceries, and healthcare. These are non-negotiable costs required for daily living.

30% for Wants: Discretionary spending that enhances life but isn’t essential—dining out, entertainment, hobbies, travel, streaming services, gym memberships, and shopping for non-essentials.

20% for Savings and Debt Repayment: Future-focused financial health—emergency fund contributions, retirement savings, investment contributions, and extra payments toward debt beyond minimums.

This rule isn’t rigid. If you live in a high-cost area, needs might consume 60% of income. If you’re aggressively paying off debt, you might allocate 30% to debt repayment. Adjust proportions based on your situation and goals.

Read more: How to Improve Your Credit Utilization Ratio?

Step 5: Record Every Transaction

Consistency determines success in expense tracking. Record transactions as they happen or establish a daily routine for logging expenses.

Real-time tracking: Enter purchases immediately using your phone. This approach prevents forgotten transactions and maintains up-to-date records.

Daily review: Set aside 10 minutes each evening to review the day’s spending. Check bank and credit card apps, review receipts, and log everything.

Weekly batch processing: Dedicate time once weekly to review and categorize all transactions. This works if you prefer consolidated sessions over daily maintenance.

Don’t forget small purchases. Those $3 coffees, $10 lunches, and $5 impulse buys accumulate quickly. Small expenses often represent the easiest opportunities for savings.

Read more: 20 Tips For First-Time Home Buyers

Step 6: Review and Analyze Your Spending

Tracking alone isn’t enough—you must review data to gain insights. Schedule regular reviews to analyze spending patterns and make adjustments.

Weekly check-ins: Quick 15-minute reviews ensure you’re on track. Compare actual spending against budgeted amounts for each category.

Monthly deep dives: At month’s end, conduct thorough analysis. Calculate total spending by category, identify overspending areas, note spending trends, and adjust next month’s budget based on findings.

Quarterly assessments: Every three months, look for broader patterns. Do you consistently overspend in certain categories? Has your income changed? Have fixed expenses increased? Use these insights to refine your tracking system and budget.

Annual reviews: Once yearly, evaluate overall financial progress. Calculate total yearly spending by category, assess whether you met savings goals, review debt reduction progress, and set financial goals for the coming year.

Read more: Savings Vs. Investing: Which One Should You Choose?

Step 7: Identify Areas to Reduce Spending

Armed with spending data, pinpoint opportunities to cut costs without sacrificing quality of life.

Attack the Big Three

Housing: If rent or mortgage exceeds 30% of income, consider downsizing, relocating to a less expensive area, taking on a roommate, or negotiating rent renewal rates.

Transportation: Evaluate whether you need a car or could use public transit, consider selling vehicles with high payments for reliable used alternatives, combine errands to reduce fuel consumption, or refinance auto loans at lower rates.

Food: Meal plan to reduce grocery waste and impulse purchases, cook at home more frequently, pack lunches instead of buying them, and use grocery apps to find deals and coupons.

Eliminate Subscription Creep

Review monthly subscriptions and cancel unused services. Most people pay for multiple streaming services, gym memberships they don’t use, magazine subscriptions they don’t read, and app subscriptions they’ve forgotten about. Conduct a subscription audit quarterly.

Negotiate Regular Bills

Many providers offer discounts if you ask. Get their network and call them to negotiate:

- Cable and internet services

- Cell phone plans

- Insurance premiums

- Credit card interest rates

Even small reductions of $10-20 per service add up to significant annual savings.

Reduce Discretionary Spending

Once necessities are optimized, examine wants:

- Set spending limits for dining out

- Find free entertainment options in your community

- Wait 24-48 hours before making non-essential purchases

- Use the “cost per use” calculation for purchases

- Unsubscribe from promotional emails that trigger impulse buying

Read more: 15 Best Online Banks For Reliable Savings

Step 8: Automate Where Possible

Automation removes the burden of remembering to track and pay, while ensuring important financial obligations are met.

Automate bill payments: Set up automatic payments for fixed expenses like rent, insurance, and minimum debt payments. This prevents late fees and ensures consistency.

Automate savings: Schedule automatic transfers to savings accounts on payday. Treating savings as a non-negotiable expense builds wealth faster.

Automate investments: Set up automatic contributions to retirement accounts and investment accounts. Dollar-cost averaging reduces the impact of market volatility.

Use alerts: Enable spending alerts from your bank and credit card companies. Set notifications for large transactions, low balances, and unusual activity.

Automation works best for fixed expenses. Maintain manual oversight of variable expenses where you have more control.

Read more: Best Bank Bonuses And Promotions in the US

Step 9: Plan for Irregular Expenses

Many people’s budgets fail because they don’t account for irregular expenses that occur quarterly or annually. These include:

- Car registration and taxes

- Holiday gifts and celebrations

- Vacation expenses

- Property taxes

- Annual subscription renewals

- Home and vehicle maintenance

Create a separate category for irregular expenses. Calculate the annual total for these costs, divide by 12, and set aside that amount monthly. When these expenses arise, you’ll have funds ready rather than disrupting your budget.

Step 10: Adjust Your Budget Based on Reality

Your first budget attempt won’t be perfect—and that’s expected. Use tracking data to create increasingly accurate budgets.

If you consistently overspend in a category, either increase the budgeted amount (and reduce spending elsewhere) or identify why overspending occurs and address the root cause.

If you underestimate a category, you’re either being too restrictive or you’re not accounting for legitimate needs. Adjust upward to create a sustainable budget you can maintain long-term.

Advanced Tracking Strategies

Once you’ve mastered basic expense tracking, consider these advanced techniques:

Zero-Based Budgeting

Assign every dollar a purpose before the month begins. Income minus all planned expenses (including savings) should equal zero. This method maximizes intentionality in spending decisions.

Envelope System

Allocate cash for variable expense categories into physical or digital envelopes. When an envelope is empty, spending stops in that category. This creates firm boundaries that prevent overspending.

Percentage-Based Tracking

Rather than fixed amounts, allocate percentages of income to each category. This method scales automatically with income changes and works well for people with variable income.

Account Separation

Use multiple checking accounts for different purposes—one for fixed expenses, one for variable expenses, and one for savings. This physical separation creates clear boundaries and prevents mixing funds.

Common Expense Tracking Mistakes to Avoid

Learn from common pitfalls that derail expense tracking efforts:

Being too restrictive: Budgets that allow no flexibility or enjoyment are unsustainable. Build in room for reasonable discretionary spending.

Tracking without action: Collecting data without making changes accomplishes nothing. Use insights to drive behavior modification.

Forgetting cash transactions: Cash spending disappears from digital records. Be diligent about recording cash purchases.

Ignoring small purchases: Small frequent purchases accumulate into large amounts. Track everything, regardless of size.

Giving up after overspending: One bad day or week doesn’t negate progress. Resume tracking immediately rather than abandoning the system.

Not involving household members: If you share finances with a partner or family, everyone must participate in tracking for complete accuracy.

Integrated Digital Ecosystems: Many neobanks and traditional institutions now offer fully mobile expense tracking within their banking apps, automatically categorizing transactions as they occur.

When to Seek Professional Help

You need a reliable method for how to track your monthly expenses, as DIY methods are not 100% accurate. Consider consulting a financial advisor if you:

- Have complex financial situations involving multiple income streams or investments

- Struggle with debt despite tracking and budgeting efforts

- Face major financial decisions like buying a home or planning retirement

- Experience significant life changes affecting finances

- Feel overwhelmed despite your best tracking efforts

Financial advisors can provide personalized strategies, accountability, and expertise that accelerate progress toward your goals.

Taking Control of Your Financial Future

Tracking monthly expenses is the foundation of financial wellness. It transforms money from an abstract concern into concrete data you can analyze and improve.

The basic summary of how to track your monthly expenses is to start small. Choose one tracking method and commit to using it consistently for one month. Review your spending patterns, identify one area to improve, and implement a specific change. Build from there.

The goal isn’t perfection—it’s progress. Each month of tracking provides insights that inform better decisions. Over time, expense tracking becomes habitual, requiring less active effort while providing greater financial clarity and control.

Your financial future isn’t determined by how much you earn but by how intentionally you manage what you have. Expense tracking is the tool that makes intentional management possible.

FAQs About Tracking Monthly Expenses

Here are some frequently asked questions about tracking monthly expenses. Check them out for better understanding;

How often should I track my expenses?

Ideally, track expenses daily or in real-time to maintain accuracy. At minimum, review and categorize transactions weekly. Monthly reviews alone often result in forgotten purchases and missed patterns.

What’s the best app for tracking monthly expenses?

The best app depends on your needs. Mint excels at automation and bank syncing, YNAB is ideal for zero-based budgeting, PocketGuard simplifies tracking for beginners, and Goodbudget works well for envelope budgeting. Try free versions to find what fits your style.

How do I track cash expenses effectively?

Save all receipts and log them daily, use your phone to photograph receipts immediately, estimate and record ATM withdrawals by category, or switch to card payments for better automatic tracking. Cash is the hardest to track but often reveals significant spending leaks.

Related Contents:

- Debt Snowball vs. Avalanche Method: Which Pays Off Debt Faster?

- How to Create a Debt-Free Budget: 5 Key Strategies

- How to Pay Off Debt Quickly

- A Deep Dive into Secured vs Unsecured Loan

- How to Improve Your Credit Utilization Ratio?

- 20 Tips For First-Time Home Buyers

- Savings Vs. Investing: Which One Should You Choose?

- 15 Best Online Banks For Reliable Savings

- Best Bank Bonuses And Promotions in the US