Written by: Segun Akomolafe

In today’s digital world, online banks have revolutionized how you manage your money. Without the overhead costs of physical branches, these institutions often offer higher interest rates and lower fees than traditional banks. But with countless options available, finding the right fit for your savings goals requires careful consideration. In this article, we’ll explore the 15 best online banks for reliable savings.

What Makes an Online Bank Worthwhile?

Before diving into specific recommendations, you should understand what separates the best online banks from the rest:

- High Annual Percentage Yield (APY): The most competitive online banks offer rates significantly higher than the national average of 0.45%

- Minimal fees: Look for accounts with no monthly maintenance charge.

Minimum Balance Requirements:

- Strong security measures: Multi-factor authentication, encryption, and fraud monitoring

- User-friendly interfaces: Intuitive mobile apps and websites for seamless money management

- Accessible customer service: 24/7 support through multiple channels (chat, phone, email)

Now, let’s explore the 15 best online banks for reliable savings this year:

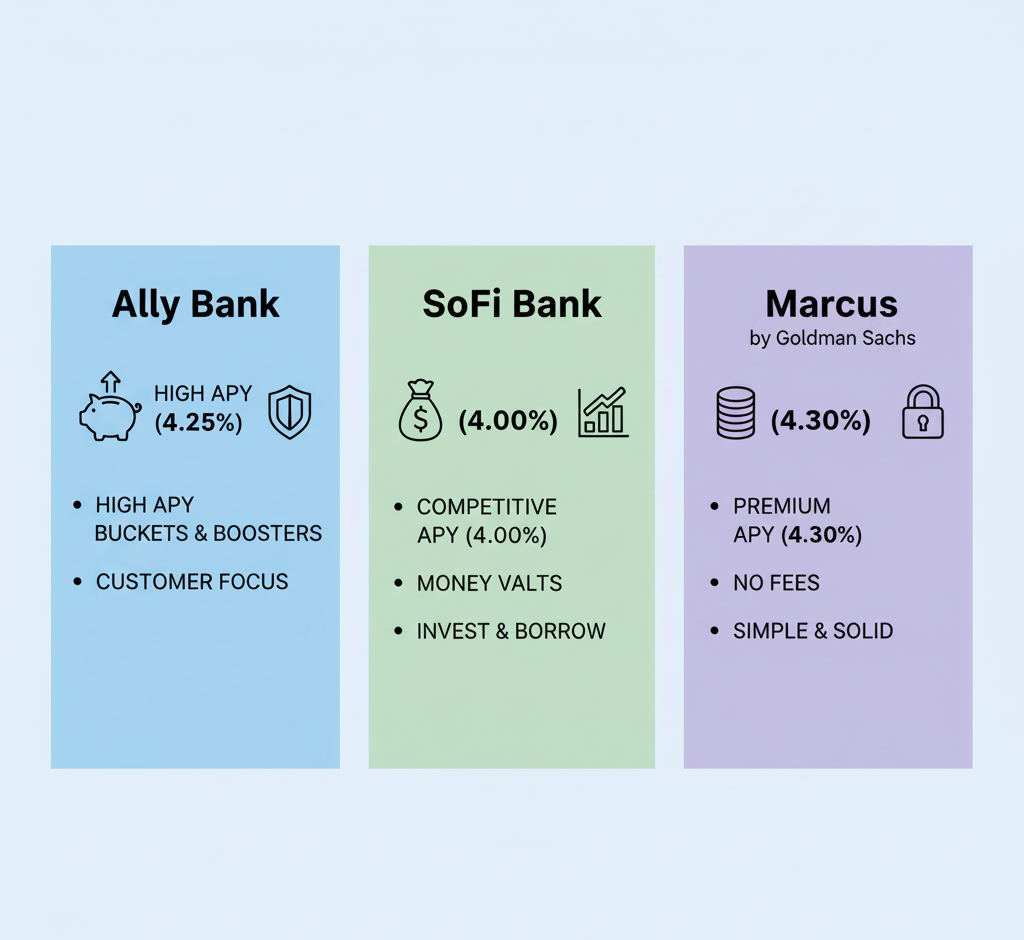

Ally Bank: Best Overall Online Bank

Ally has established itself as the gold standard for online banking. With a current APY of 4.25% on savings accounts and no minimum deposit requirement, it makes building your emergency fund or saving for major purchases remarkably accessible.

The bank’s intuitive mobile app allows you to organize your savings into different “buckets” for various goals. Need to separate vacation funds from your home down payment savings? Ally makes this categorization simple without requiring multiple accounts.

Ally also stands out for its exceptional customer service, available 24/7 through phone, chat, and email. Their representatives consistently receive high marks for knowledge and helpfulness – a crucial factor when your bank lacks physical branches. This makes Ally bank one of the 15 best online banks for reliable savings.

SoFi: Best for Cash Management

SoFi has transformed from a student loan refinance into a comprehensive financial platform. Their checking and savings hybrid account currently offers 4.50% APY when you set up direct deposit, placing it among the highest-yielding accounts available.

What sets SoFi apart is its “money vaults” feature, which lets you create up to 20 separate savings categories within your account. This makes tracking progress toward multiple financial goals remarkably straightforward.

The SoFi platform also provides investment options, loan products, and financial planning tools, making it an excellent choice if you prefer consolidating your financial life in one place.

Capital One 360: Best Hybrid Option

Capital One straddles the line between traditional and online banking. While maintaining physical locations in some states, it is considered as one of the 15 best online banks for reliable savings because it offers full-featured online accounts with competitive rates. Their Performance Savings account currently yields 4.10% APY with no fees or minimum balance requirements.

Their mobile app ranks among the best for user experience, with intuitive navigation and useful features like instant transaction notifications and easy mobile check deposit. If you occasionally value face-to-face banking but primarily manage money digitally, Capital One offers the perfect compromise.

Discover Bank: Best for Cash Back Perks

Discover has leveraged its credit card expertise to create an impressive online banking platform. Their savings account offers a solid 4.15% APY, but what truly distinguishes them is their checking account, which provides 1% cash back on up to $3,000 in debit card purchases monthly.

This unique combination allows you to earn while saving and spending. Discover also excels in customer satisfaction, consistently ranking at the top of J.D. Power’s banking surveys.

Marcus by Goldman Sachs: Best for Simplicity

Marcus is one of the 15 best online banks for reliable savings because it offers a streamlined banking experience without sacrificing quality. Their high-yield savings account currently pays 4.30% APY with no fees or minimum deposit requirements.

What makes Marcus particularly attractive is its straightforward approach – they focus on doing a few things exceptionally well rather than providing dozens of complex account options. If you want a high-yield account without navigating complicated features, Marcus delivers exactly that.

Synchrony Bank: Best for ATM Access

Synchrony combines competitive rates with practical features for savers who occasionally need cash. Their high-yield savings account offers 4.35% APY, ranking among the market leaders.

Unlike many online banks, Synchrony provides a debit card with their savings account and reimburses ATM fees nationwide. This unusual combination gives you the liquidity advantages of a checking account with the high interest of savings.

Axis Bank: Best Interest-Bearing Checking

Axos stands out for offering interest on its checking accounts – up to 3.30% APY if you meet certain monthly requirements like direct deposit and debit card usage. Their savings account currently pays 4.20% APY.

Founded in 2000, Axos (formerly Bank of Internet USA) was one of the first digital-only banks in America. This experience shows in their mature platform and comprehensive service offerings.

Varo Bank: Best for Automatic Savings

Varo has distinguished itself with innovative automatic savings features. Their Save program rounds up your transactions to the nearest dollar and transfers the difference to savings. Additionally, they offer up to 5.00% APY on balances up to $5,000 when you receive direct deposits of at least $1,000 monthly.

As one of the newer digital banks, Varo has built its platform specifically for mobile users, resulting in an exceptionally intuitive experience. If you struggle with saving discipline, Varo’s automation tools can help develop better habits.

Chime: Best for Early Direct Deposit

Chime has gained popularity for allowing customers to access their direct deposits up to two days earlier than traditional banks. Their savings account offers 4.00% APY – slightly lower than some competitors but compensated by their user-friendly features.

Like Varo, Chime provides automatic savings through transaction round-ups. Their “Save When I Get Paid” feature automatically transfers a percentage of your direct deposits to savings, helping you build wealth without thinking about it.

Wealthfront: Best for Automated Investing

Wealthfront blends high-yield savings with automated investing opportunities. Their cash account currently pays 4.55% APY while providing FDIC insurance coverage up to $2 million through their partner banks.

What makes Wealthfront unique is the seamless integration between savings and investing. You can easily move money from your cash account into low-cost investment portfolios based on your risk tolerance and goals, making it ideal for long-term wealth building.

American Express National Bank: Best for Existing Amex Customers

If you already have an American Express credit card, their online savings account deserves your consideration. Currently offering 4.25% APY with no fees or minimums, it integrates smoothly with your existing Amex dashboard.

While American Express doesn’t offer checking accounts, their savings product excels with reliable customer service and the security reputation of a major financial institution.

CIT Bank: Best for Tiered Savings Options

CIT Bank provides several savings account options with varying rates based on your preferences. Their Premier High Yield Savings currently offers 4.65% APY, while their Savings Connect account pays 4.75% APY when linked to a CIT eChecking account with monthly deposits of $200+.

This tiered approach allows you to choose the account structure that best matches your financial habits. CIT also offers competitive money market accounts and CDs for diversifying your savings strategy.

Quontic Bank: Best for Unique Checking Options

Quontic has created innovative checking accounts that pair well with their high-yield savings (currently 4.40% APY). Their Bitcoin Rewards Checking provides 1.5% in Bitcoin on eligible debit card purchases, while their High Interest Checking pays up to 2.50% APY.

As a certified Community Development Financial Institution, Quontic focuses on serving underbanked populations. Their creative account structures make them worth considering if you’re looking for something beyond traditional savings options.

LendingClub Bank: Best for Rewards Checking

LendingClub Bank (formerly Radius Bank) offers a compelling combination of high-yield savings (4.25% APY) and rewards checking. Their Rewards Checking account provides 1% cash back on qualifying purchases and up to 1.00% APY on balances over $2,500.

Their early direct deposit feature and unlimited ATM fee rebates worldwide make this an excellent option for frequent travelers who still want competitive savings rates.

Bread Financial: Best for CD Rates

Formerly known as Comenity Direct, Bread Financial specializes in certificates of deposit with some of the most competitive rates in the industry. Their High-Yield Savings Account currently offers 4.50% APY, while their 1-year CD pays 5.15%.

If you’re comfortable locking away some funds for specific time periods, Bread’s CD ladder options can help you maximize interest while maintaining some liquidity through staggered maturity dates.

Read more: Best Bank Bonuses And Promotions in the US

Making Your Final Decision

While interest rates often grab headlines, your ideal online bank depends on your specific financial habits and goals. Consider these questions before making your choice:

- How important is having occasional access to physical branches?

- Do you prioritize mobile app functionality or website experience?

- Are you looking to consolidate multiple financial services with one provider?

- How often will you need to withdraw cash?

- Do you prefer automated savings tools or manual management?

Remember that interest rates change frequently based on the broader economic environment. The best strategy involves selecting a bank with a history of competitive rates rather than chasing temporary promotions.

Most importantly, many of these online banks allow you to open accounts with no minimum deposit and no risk. Consider testing a new account alongside your current banking relationship before making a complete switch. This hands-on experience will tell you more about whether an institution meets your needs than any review ever could.

By taking advantage of the higher yields and lower fees these online banks offer, you’re making a smart choice that can significantly impact your long-term financial health. Even a 1% difference in interest rates can mean thousands of additional dollars in your account over time – money that’s earned without any extra effort on your part.

Related Contents: